Deep Dive 5: A quick look at large health system incentives

It's still a fee-for-service world, and we're all just living in it

Welcome back to another Donut Hole Deep Dive! If you missed any of our previous issues, you can find them here. One issue we’ve touched on many times in our Weekly Updates is the growing trend of value-based care. It’s an exciting area to be sure with lots of innovation and discussion around specific structures, including global capitation, primary care capitation, and shared savings and downside risk. But the reality is that fee-for-service (FFS), where providers get paid for each service delivered independent of outcomes, still rules the U.S. healthcare landscape. Physician practices and health systems make a majority of their revenue from FFS, and any sober analysis of the U.S. landscape needs to start with our FFS reality.

Admittedly, this post may read as a tad pessimistic. But the intent here is not to bash the advances and investments in value-based care and risk-sharing primary care models. There is some amazing work happening. Rather, we wanted to call attention to how influential the FFS model remains and comment on the implications for those who are involved in one way or another in healthcare innovation, such as those involved in public policy, care quality initiatives, and vendors that sell to health systems.

So, how do health systems behave and what initiatives do they prioritize in our FFS world? Lucky for us, there are several publicly traded health systems that must report their financial results to the public and answer questions from equity analysts. We’ve decided to dig into the largest one, HCA Healthcare (ticker symbol: HCA), for this post, but you could similarly look at Universal Health Services (UHS), Community Health Systems (CYH), Tenet Healthcare (THC), or a range of other more specialized provider organizations. Basically, it all boils down to Charlie Munger’s famous words, “Show me the incentives and I will show you the outcome.”

Below, we’ll walk through the key metrics reported in HCA’s most recent earning announcement, pick out key quotes from their call with equity analysts, and discuss their senior leadership compensation. Each will highlight that HCA has predictably focused on increasing procedure volume and patient stay days over care quality, preventative measures, and other value-based care workstreams.

Finally, we’ll share our thoughts on what this means for our healthcare system and innovation. After all, HCA is not alone, and they aren’t doing anything wrong either. HCA is simply responding to the incentives inherent in our system.

Earnings announcement emphasizes volumes

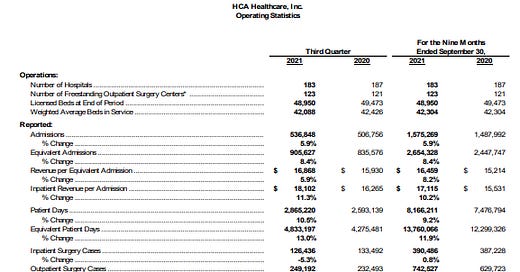

Public companies must release quarterly earnings to the public that detail financial performance and provide updates on key metrics the companies believe are useful to their current and potential shareholders. HCA’s third quarter 2021 earnings announcement highlights its quarterly financial performance, an impressive $15.3B of revenue and $3.2B of EBITDA (a financial metric that’s widely regarded as a quick proxy for a company’s cash flow)! More significantly for our purposes here, HCA also reported on its key operating statistics, the key metrics it believes are most valuable to shareholders. Both the short summary and full list of metrics are shown below.

Look at these metrics. What do they show? Well, they show a healthcare delivery company that is focused on volumes - admissions, total inpatient days, surgery volume, and emergency room visits. Missing is any metric associated with value-based care models (i.e. number of patients enrolled in new care models), population health, care quality, etc. HCA just wants more patients and more procedures. That’s their definition of success and the metrics on which they want their shareholders to focus.

Earnings transcript highlights volume growth

In addition to earnings releases, publicly traded companies also hold quarterly calls to provide commentary on their results and answer questions from equity analysts. In HCA’s latest earnings call, the discussion predictably centered on COVID. But HCA management also commented on the core business dynamics. Key quotes from the transcript include:

“Overall, we believe demand will return to historical trends for us, with volumes growing across most categories in the 2% to 3% zone.”

“We are working our way through reopening surgery capacity across the company in an appropriate fashion. And we really don't see any structural issues with our surgical activity across the company.”

“Well, our inpatient surgeries were the only metric, again, as I mentioned in my comments that were down for the quarter. And that's because we used a lot of the space that was necessary for COVID patients. Our outpatient activity was up. It was up 7%. It was up more in our freestanding ASCs than it was in our hospitals, but both were up. And then when you look at it against 2019, I think, again, we had growth, with the exception of inpatient surgery freight. And that, again, is a direct correlation to the fact that we needed that space for COVID inpatients in order to manage our capacity from both staffing and a bed standpoint.”

“But in particular, on the outpatient side, we've added a reasonable number of new facilities, whether it's new urgent care center platform, new freestanding emergency rooms, some ambulatory surgery. And then we've added to our physician platform over the last 18 months. Some of which has been development of existing practices in our communities, but also new practice acquisitions that have added to our offerings.”

Not surprisingly given the metrics they share, HCA’s commentary focuses on procedure volume recovery and growth and facility expansion. There was only one question on value-based care from analysts, and the answer was hardly an alarm that value-based models were coming to transform how HCA is reimbursed. Below is HCA’s response to the question, “From the perspective that HCA is the largest hospital operator in the country, one of the largest employers of physicians in the country, how do you look at the value-based care movement?”

“Is [value-based care] accelerating in our facility structures? No. Inside of our physician platform, we do see opportunities to continue to push further into value-based care. Again, in that particular platform in our company, we have aspects of value-based care. They vary a little bit from one market to the other depending on the circumstances and the demographics and payer dynamics in those markets. So we do see it growing more in the physician platform than on the facility side, I would submit. But I think if you pull up, and you look at our relationships across the organization in the payer environment, they're very strong. We're 80%, 85% contracted for 2022. We're about 50% contracted for 2023 on terms that work for both organizations. They continue a lot of the structure that's already in place. And we evolve, as we renew with what's going on in the marketplace.”

HCA expects some value-based care initiatives around the margins of its business, but that’s all.

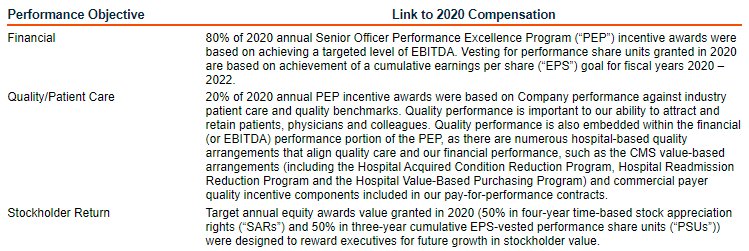

Executive compensation prioritizes financial performance

Public companies share details on executive compensation in annual proxy statements, which are statements that provide stockholders with important information ahead of annual meetings and shareholder votes. Looking at HCA’s most recent proxy statement from April 2021, 80% of 2020 executive cash compensation was based on EBITDA performance, i.e. financial results. 20% was based on quality measures, but those measures are not aligned with value-based care, at least not directly. Rather, the measure is comprised of patient satisfaction scores and HCA’s performance managing hospital-acquired infections like sepsis and MRSA. It’s true that these quality scores can impact reimbursement from Medicare and other payors (e.g. Medicare’s Hospital Acquired Condition Reduction Program), but they are a far cry from anything resembling capitation or other at-risk models. Additionally, executives receive stock-based compensation was tied to Earnings Per Share (EPS) performance, another pure financial metric.

So what?

OK, so what? What does HCA’s focus on procedure volume and patient stay growth mean for our healthcare system and everyone trying to improve it? First, let’s reiterate that this piece isn’t demonizing HCA. There is nothing wrong with HCA’s strategy and key operating metrics. The company is acting in the interest of their shareholders, which is their fiduciary duty. If we want HCA and other health systems to prioritize different metrics, like ones more aligned to primary care quality and preventative measures, then we need to push for policy changes aligned to those goals. Healthcare delivery organizations will not change without that push, and honestly, as a public company with shareholders, nor should they. With that out of the way, let’s discuss a few key areas of impact.

A lesson for healthcare innovators seeking health system customers

As those of you working at provider-focused vendors probably know, health systems are awful customers. A single sales cycle can last years, and projects must go through round after round of internal review before receiving approval. And that’s for the solutions that end up getting purchased! The vast majority are rebuffed well before then. Often, vendors are confused about why their solution wasn’t purchased. And usually the answer is that the solution, such as care coordination software or point solution patient safety software, is not aligned to a fee-for-service world. It either increases operating costs and complexity (i.e. clinical workflows) but not revenue or even may reduce procedure and visit volumes. Looking at HCA’s executive incentives, most of what impacts their compensation is financial performance (higher revenue, lower costs), and the quality measures that do impact them are largely focused on infection reduction. If your solution doesn’t help either cause, you’re probably not landing a contract. It’s a similar dynamic to the examples we discussed in our Relative Value Unit (RVU) Deep Dive. It’s just very difficult to get physicians and provider organizations to behave in ways that are not aligned to their FFS-driven incentives.

Legacy industry incumbents will not lead, and will likely oppose, the transformation of U.S. healthcare

This shouldn’t come as a surprise, but waiting on legacy provider groups to drive meaningful transformation of U.S. healthcare isn’t going to work. Organizations like HCA have spent decades building very large businesses perfectly aligned to the FFS status quo. Yes, they accept innovation around the edges with minor bonuses or penalties around certain quality metrics, but they will fight to prevent any reform that meaningfully targets their volumes and pricing. Just look at the American Hospital Association’s and American Medical Association’s attempt to block the recent bill that banned surprise billing.

Meaningful innovation around population health and at-risk provider models, initiatives that have the potential to actually bend the healthcare cost curve in this country, will have to come from a combination of regulatory / policy initiatives and innovators who work around and even replace existing provider organizations.

Preventative primary care and HCA can both succeed, but the current system would need to change

We believe that HCA’s success does not have to be at the expense of value-based care and improved population health. Rather, there is a potential future where they work well in tandem. In this future, everyone is enrolled in proactive, accessible value-based primary care. Care teams work to keep people healthy, resulting in a lower burden of preventable chronic disease. For those who do develop conditions, primary care teams help slow disease progression and limit complications. Inevitably, though, people will still need surgical and diagnostic procedures. When the need for a procedure arises, primary care teams will send their patients to the highest quality option, presumably a hospital or surgery center that would get paid on key outcome measures (30 day readmission, infections, etc.) but still be largely FFS-based. For this future to occur, though, we’d need to de-couple primary care from hospitals to ensure that primary care teams are not impacted by referral incentives (see this recent lawsuit around Hartford Healthcare’s alleged aggressive referral management tactics). We’d also need to ensure sufficient hospital competition in each market. If HCA owns 85% of the hospitals in a specific geography, for example, it’d be very difficult to receive care elsewhere. Finally, we’d need to continue the trends around increased transparency into hospital cost and quality data. Each initiative will require regulatory action, unfortunately, and given our history of pushing major changes through Congress, don’t hold your breath. Still, we can dream!

Thanks for reading!

— Hannah and Caleb Bank, Co-founders

Want to know more about who we are? Read our “About” page!

Follow us on Twitter to never miss an update!

Have any comments, questions, or suggestions?

If you’re not already a subscriber, sign up now so you don’t miss the next issue!