Deep Dive 2: Traditional Medicare and Medicare Advantage

An intro to the programs, key differences, and policy implications

We hope you enjoyed our first Deep Dive, which covered the shortcomings of prescription drug plan design. As a follow-up, we wanted to expand on another recurring subject in our weekly updates, Medicare Advantage (MA). Medicare Advantage is a rapidly growing program with 26M covered lives. In addition, it is seen as a potential solution for universal coverage and has attracted an enormous amount of private investment. But what is MA? And is its seemingly unstoppable growth a good thing?

In this post, we will provide a high level background on traditional Medicare and MA and review how the programs differ. We will also point out some important shortcomings of MA and discuss potential reforms. Medicare Advantage is core part of the American healthcare landscape, and while it has many positives, there are some concerning trends that have to be addressed.

And per our last deep dive, we will be staying fairly high level. There are loads and loads of nuances to everything in the below. Please click on the many linked sources if you want to dive deeper or keep an eye out for future Donut Hole Deep Dives!

What is Medicare?

Let’s start at the beginning with Medicare. Medicare, passed in 1965, provide health insurance for legal residents aged 65 and older. The program also covers those with disability status, such as those with ALS or end stage renal disease, but this post focuses on the coverage for the seniors. Medicare is run by the Centers for Medicare and Medicaid Services (CMS) and provides health coverage for over 52M seniors. The program is divided into four main parts:

Part A covers in-patient stays, post-discharge skilled nursing, and hospice services

Part B covers outpatient services, including office visits, durable medical equipment, and infusion centers for professionally administered prescription drugs

Part D covers self-administered prescription drugs via privately-run plans (i.e. run by private health insurance companies)

Part C is Medicare Advantage, also called Managed Medicare, in which individuals enroll in privately-run health plans that provide at least the same level of coverage as Parts A and B (and usually Part D)

So, basically, any individual eligible for Medicare can choose to sign up for Parts A, B, and D or select an all-encompassing plan from a private insurer.

The costs of Medicare for the beneficiaries are a little complicated but for most people, there is a $148.50 monthly premium for Part B coverage and an additional monthly premium for Part D coverage (exact amounts depend on the specific Part D plan). The vast majority of beneficiaries don’t pay a premium for Part A coverage.

Part A then has a $1,484 deductible per hospitalization with no further cost sharing for stays shorter than 60 days. Part B has a $203 annual deductible. Once that deductible is met, beneficiaries pay 20% coinsurance of the Medicare-approved amount for Part B services they receive. Part D plans typically include copays for each prescription.

Importantly, there is no annual limit for out-of-pocket spending in traditional Medicare. For this reason, most Medicare enrollees also sign up for Medicare Supplement Insurance (Medigap), a supplemental plan to help cover Part A deductible and Part B coinsurance costs. There are several versions of Medigap plans, but most cover 100% of costs aside from the Part B deductible. This generous coverage comes at a price, typically more than $150 per month. But it does provide protection for enrollees who otherwise would have incurred unaffordable charges.

Medicare enrollees can see any doctor or hospital that accepts Medicare across the country and do not need referrals to see specialists, a core benefit of traditional Medicare. But Medicare does not provide coverage for dental, hearing, or vision services. This issue has been in the news recently as President Biden and Congressional Democrats aimed to include these services in the Build Back Better Act. Currently, that doesn’t look like it will happen.

What is Medicare Advantage?

So what do MA plans look like? Well, they look a lot like health insurance you would find in the Commercial space, where individuals enroll in plans that cover everything from in-patient stays to outpatient surgeries to prescription drugs all under the same umbrella. MA plans also typically have lower deductibles than Part A or B and provide their own out-of-pocket annual limits for medical expenses, which is currently $7,550 for in-network care. To clarify, individuals enrolled in MA plans are not eligible to also sign up for Medigap plans as many of the benefits are already designed into the Medicare Advantage plan design. MA has exploded in popularity over the past 15 years, and currently serves 26M people.

MA plans offer another compelling value to enrollees. They can cover additional services that traditional Medicare doesn’t. Per the graph below from KFF, most MA plans provide dental, hearing, or vision services as well as fitness and over-the-counter benefits. More plans are also adding covered services to help members with meals and transportation.

But the simplicity of coverage (i.e. no need for Medigap; Parts A, B and C under the same umbrella) come at a cost. As with Commercial plans, MA plan enrollees are limited to a plan’s specific provider network, which can be limiting, and may need referrals to see specialists. Furthermore, MA plans nearly universally require prior authorizations to receive DME, skilled nursing services, professionally administered drugs, and home health care, among other services. Simply put, individuals in MA plans face significantly more restrictions than traditional Medicare enrollees on the providers they can see and the specific services they can access.

While this post focuses more on the patient experience, it is worth spending a little bit of time on how the MA program works at the health plan / CMS level. Health plans are responsible for recruiting their own members each year. Then, health plans receive monthly capitated payments from CMS for each enrollee. The formula behind the capitated payments is extremely complex, but it takes into account plan geography and quality (i.e. a plan’s STAR rating). For reference, in 2021, the average monthly capitated payment was ~$1,000 per month. Most importantly, CMS adjusts the monthly payments made to a specific plan based on how sick the underlying patient population is. This is done via a process known as risk adjustment. The risk adjustment process begins with providers and health plans confirming diagnoses at the individual patient level. Diagnoses are then grouped into condition categories, known as hierarchical condition category (HCC) codes, that have similar Medicare predicted costs. Finally, this data is run through specific CMS models to calculate risk scores. Health plans with higher risk scores are paid an additional amount to help offset the increased costs of care for the sicker populations. But, as we’ve noted previously, this risk adjustment process is rife with foul play. Health plans can game the risk adjustment in a number of different ways, including post-visit chart reviews to find additional codes that don’t impact patient care, offering bonus payments to providers for submitting additional codes, or even owning the providers themselves. Health Affairs provides an excellent overview of the problems with risk adjustment for those of you who want to dive deep into the weeds.

We should also note that Medicare Advantage includes special needs plans (SNPs). There are three types of SNPs. The largest by far is dual eligible plans, which are available to people who qualify for both Medicare and Medicaid. The other two are plans for people with severe chronic or disabling conditions and for beneficiaries requiring a nursing home or institutional level of care. 3.3M people were enrolled in SNPs in 2020, 2.9M of whom were in dual eligible SNPs. For the purposes of this post, we are largely ignoring these plans as they are tailored to serve very specific patient populations.

Comparing MA and Traditional Medicare Benefits

OK, so how should enrollees think about the two programs? The truth is that both options have their strengths and weaknesses. It is important for individuals to consider their particular health and financial circumstances when deciding which option is best for them.

If you value the freedom of being able to go to practically any doctor you want without a referral, receive complex care without first needing prior authorizations, frequently travel or split time between multiple residences, or don’t mind managing a Medigap policy on top of Part A, B, and D enrollment, traditional Medicare may be the better option for you.

If you want a plan that’s easier to manage, have high quality local provider networks and don’t travel often, or value additional benefits like dental, vision, and hearing coverage, Medicare Advantage could be a better fit.

In terms of costs, either option could result in more out-of-pocket spending. Medicare Advantage may be cheaper for some since MA plans typically have lower deductibles than traditional Medicare, lower monthly premiums than Medigap plans, no additional premium for Part D coverage, and offer additional benefits. But there are situations where it would be financially advantageous to enroll in traditional Medicare with a Medigap plan, too. Individuals should consult with a licensed insurance broker to see which option is best for them.

Problems with Medicare Advantage

Problems with MA can be split into two categories: issues for the individual enrollees and issues with the overall program.

Problems for Individual Enrollees

For individual enrollees, the potential problems mirror issues with Commercial plans.

Restrictive networks: for 2022, 59% of all plans offered to enrollees are health maintenance organization (HMOs), which have the most restrictive provider networks and exert the most control over care decisions, and 37% are local Preferred Provider Organizations (PPOs). Health plan networks are constantly in flux, so members who sign up for HMOs and local PPOs may soon find that their preferred providers are no longer in their plan’s network.

People don’t shop for plans: we covered this story in a recent issue, but it’s worth reiterating that ~70% of Medicare Advantage beneficiaries do not compare plans during the open enrollment period. To be fair, the rates are similar for those on traditional Medicare, but given that a main selling point of MA is the plan-specific extra benefits, it’d be better if more people shop around each year.

Rural areas lack choices: this one is hard to pin on MA alone. Rural healthcare is sort of a mess in general. Nevertheless, people living in rural communities have far fewer MA plan choices even as the system is designed to encourage insurance companies to enter these markets.

Problems with the Overall Program

There are many aspects of the overall Medicare Advantage program that raise questions. We could devote an entire deep dive to the specific mechanics behind each one. For this issue, though, we’ll try to keep it high level.

MA costs more without corresponding quality improvements: CMS has consistently paid MA plans more that it would have cost to cover those enrollees in traditional Medicare. In 2021, MedPAC estimates a ~4% overpayment. This would be understandable if MA plans had better outcomes or served more difficult enrollees, but the evidence suggests that the populations are similar between MA (excluding the SNPs) and traditional Medicare and that the rates of emergency room visits and hospitalizations are comparable.

Risk adjustment can be easily abused: as noted above and in several several stories we’ve recently covered (including the Department of Justice’s lawsuit against Kaiser and retroactive chart review abuse), there is significant potential for malfeasance in the risk adjustment mechanism. MA plans are incentivized to upcode, or capture as many diagnosis codes as possible even if the coded conditions don’t impact current patient care. More codes lead to higher reimbursement from CMS, which plans then partly capture as additional profit.

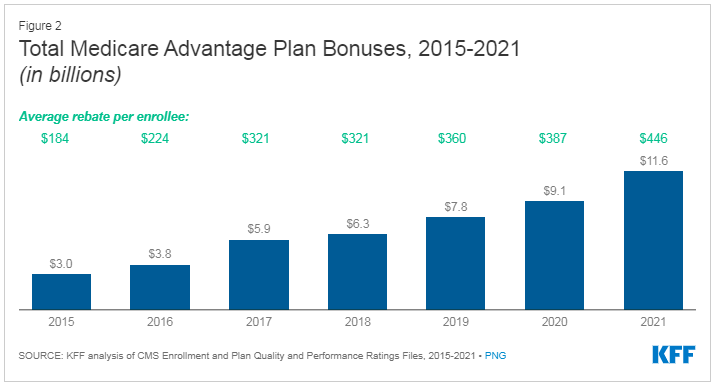

Questionable quality ratings methodology: a MA plan’s quality score, know as its Star rating, is based on nearly 50 measures such as how well they provide screenings, immunizations, and checkups and member satisfaction scores. Plans with better Star ratings receive additional bonus payments from CMS. In theory, this sounds great. In practice, though, the system has resulted in higher and higher spend CMS spending. Quality payments quadrupled from $3B in 2015 to $11.6B in 2021. The growth in the average rebate per enrollee is shown below. This is because there is no cap on quality payments. It’s not like there is a set amount of quality bonus dollars available that is then divided amongst the plans. Theoretically, CMS could provide the highest quality bonus to every MA plan out there, and the American taxpayer would foot the bill.

Potential Solutions

So what are the potential solutions? To address MA problems for individuals, we likely need to invest more in general awareness and better online tools to help people assess which option is better for them. That won’t totally solve the problem, but it’s a start.

Solving the program’s shortcomings presents a bigger challenge, particularly because MA enjoys strong bipartisan support and the health insurance lobby is geared up to crush any potential action that could make the program less financially lucrative. Nevertheless, we think there are two perhaps overly optimistic solutions that we would like to see more dialogue around.

Empower a new independent group to code diagnosis codes instead of the MA plans themselves: there is enough data and lawsuits out there to confirm that MA plans systematically upcode their patient population. To correct this, we’d like to see this coding function move under the a neutral third party. Health plans would be required to submit the relevant clinical documentation electronically, and a neutral reviewer would then make the final decision around the appropriate codes. This solution has its challenges, namely health data interoperability and a need to afford CMS and health plans some reasonable level of visibility into the coding process, but the status quo cannot persist. Moving to an independent coding process will presumably save money via more accurate risk scores for most MA plans.

Cap the amount of money available for quality payments: the growth in the average quality rebate per enrollee is unsustainable. The program should be reformed to either cap the total dollars paid or the quality bonus payment percentages should be lowered. The current system results in higher CMS spending without any discernable outcomes improvement.

Health Policy Implications

Many, including the author of this JAMA article, consider Medicare Advantage to be a model for universal coverage (i.e. “Medicare-for-all”) due to the program’s flexibility to offer additional benefits and existing bipartisan support. But we have already discussed several major issues with MA and other questions have yet to be answered. We certainly agree with the push to achieve universal coverage for Americans, but feel like we have a lot of work to do to validate if MA is truly the best option. Other paths could include expanding the ACA exchanges with more generous subsidies or providing traditional Medicare for all as a public option.

Conclusion

As with most things in life, Medicare Advantage is a mixed bag. We hope the program’s current problems receive sufficient attention from those in a position to enact changes. After all, there are many positives to build on. Who knows, perhaps one day we will be lucky to have Medicare Advantage for all!

Other news you may like:

Texas Medical Association sues to block parts of surprise billing ban

Insurers look to cut lab costs through benefit management firms

Jefferson finalizes $305M deal for Temple Health System's stake in Health Partners Plans

Democrats' drug pricing plan, while scaled back, could still squeeze pharma top-sellers

Study: Patients using Hello Heart's device lowered, maintained blood pressure

Follow us on Twitter to never miss an update!

Have any comments, questions, or suggestions?

If you’re not already a subscriber, sign up now so you don’t miss the next issue!